TransUnion Opt-Out Guide: How to Remove Your Personal Information

Overview:

What is TransUnion?

TransUnion, one of the three major U.S. consumer credit reporting agencies, gathers and maintains financial data for over a billion consumers worldwide. Its main function involves creating comprehensive credit reports from payment history, debt, public records, and account inquiries, which are then used to determine credit scores. The company supplies this vital credit and risk information to businesses such as lenders, insurers, and landlords, enabling them to make informed decisions and conduct confident transactions.

Types of personal information they expose:

TransUnion may collect and share:

Full Name

Aliases

Current and Previous Addresses

Date of Birth

Identification Numbers (e.g., Social Security Number, Driver's License or Passport Number)

Financial and Credit History (e.g., Credit Accounts including credit cards, mortgages, auto loans, and student loans, Payment History, Public Records such as bankruptcies, etc.)

Employment Information (e.g., Employment History, Titles, etc.)

Demographic Information (e.g., Gender, Marital Status, and Ethnicity)

Risks to privacy if the data is not removed:

For a credit reporting agency like TransUnion, the significant danger is in the potential for identity theft and unauthorized hard inquiries if their extensive database of sensitive information is compromised. Furthermore, keeping outdated or incorrect data can result in an inaccurate credit score, directly leading to the denial of opportunities such as loans, mortgages, rental housing, or employment.

Why this guide exists:

This guide aims to help you understand how to limit the use of your personal information by TransUnion, enhancing your privacy and reducing unwanted solicitations.

This step-by-step guide will walk you through the process of opting out of TransUnion.

Opt-Out Process at a Glance

Time to Complete: 5-10 minutes

Information Required: Full Name and Address (Street, City, State, ZIP)

Verification Required: No

Data Removal Timeline: Allow up to 45 days

VPN Required: No

Step-by-Step Opt-Out Instructions

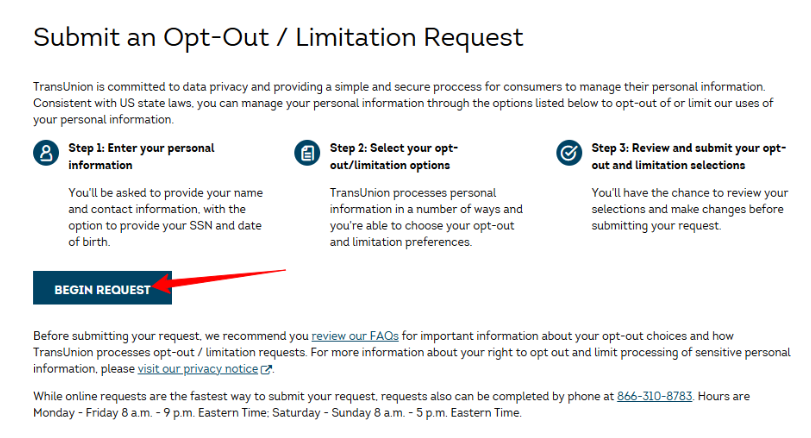

Step 1: Go to TransUnion

Visit the Opt-Out Page: https://service.transunion.com/dss/ccpa_optout.page

Step 2: Submit Opt-Out Request

Click the button "BEGIN REQUEST",

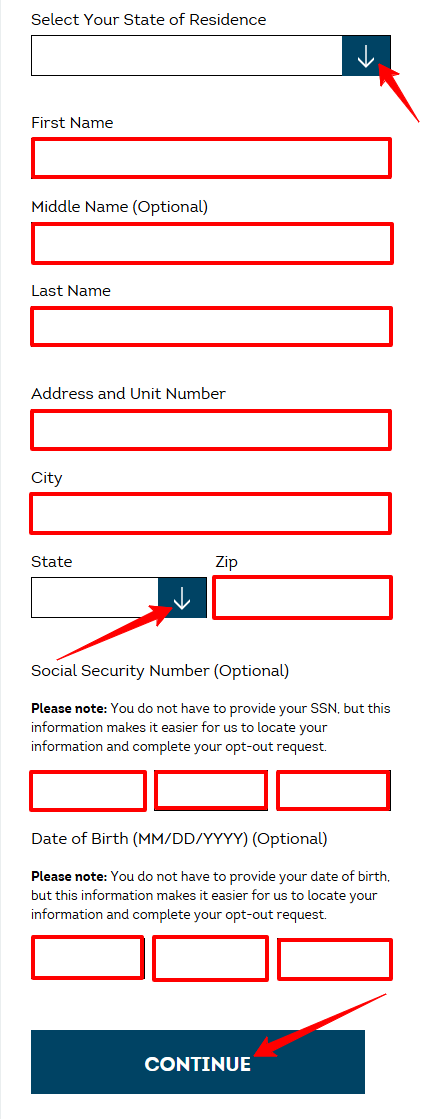

Step 3: Fill Out Form

Select your State of Residence.

Enter your First Name, Middle Name (Optional), and Last Name.

Type in your Address and Unit Number.

Type in your City, State, and ZIP Code.

Optionally, indicate your Social Security Number or Date of Birth.

Click "Continue".

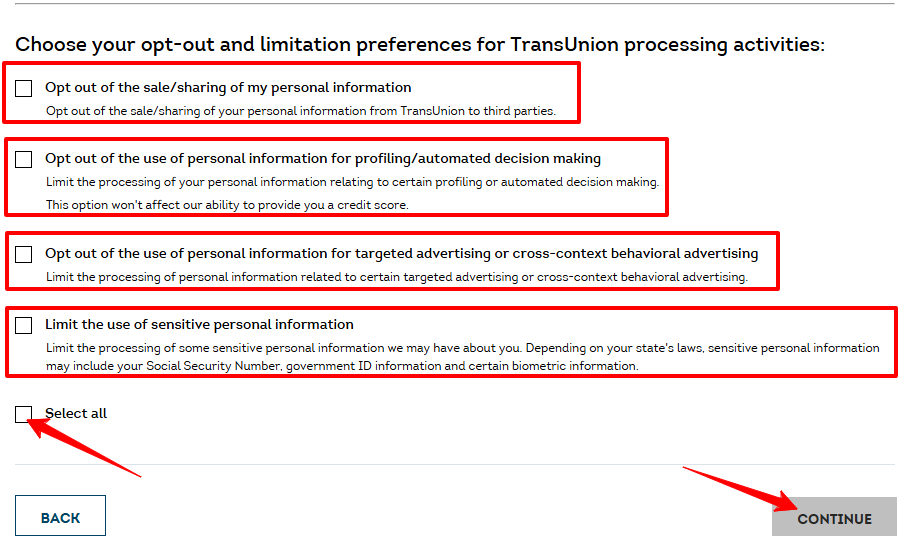

Step 4: Select Your Opt-Out and Limitation Preference

Select the opt-out option you want, or you can select all.

Click "Continue" to send your request.

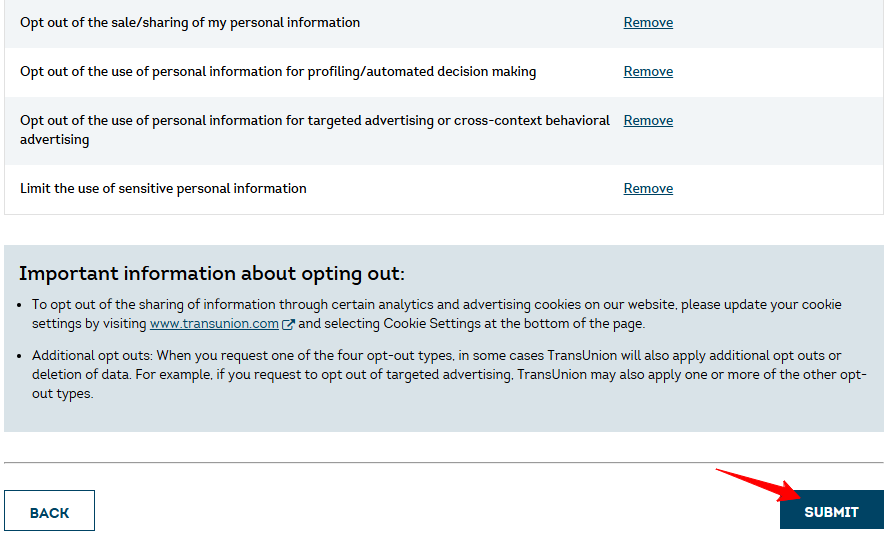

Step 5: Review and Submit Your Request

Review your request, then click "SUBMIT."

Step 6: Await Removal

Allow up to 45 days for the opt-out to be processed.

Additional Notes

Using a disposable email address can help reduce future marketing emails.

If you continue to receive unwanted offers after the opt-out period, consider contacting TransUnion directly to ensure your request was processed.

Keep records of your opt-out request for future reference.

Need Help?

If you're having trouble removing your information from TransUnion, consider using a privacy protection service like Privacy Bee or PurePrivacy that can handle the opt-out process on your behalf.